Massachusetts Legislation Update: June 2021

The newest updates from Beacon Hill (June 2021)

The 192nd General Court is in full swing for the 2021-2022 session.

With more than 6000 pieces of individual legislation filed as of late March, there is “something for everyone” on the monitoring front. As state government and society emerges from the COVID-19 pandemic, it will be interesting to see what issues gain traction and where the Legislature decides to focus.

Short-term viewing considerations include the annual state budget and the impact of the American Rescue plan on Massachusetts.

On the long-term horizon, we’re keeping an eye on the climate change policy that was just signed into law. It targets net zero carbon emissions for MA by 2050.

Learn about the implications of these pieces of legislation for your organization, and how you might be affected by their passage:

Short-term considerations for Massachusetts laws

Annual State Budget.

With House and Senate complete with their versions of the annual state budget, it now heads to a conference committee where the House and Senate will iron out their differences and hope to send the final version to Governor Baker in for the start of the fiscal year beginning July 1 st .

Some issues to track that are differing in the House and Senate versions include:

- Film Tax Credit-the House proposes to keep the tax credit indefinitely and the Senate proposes tighter restrictions on the amount and eligibility of the credit.

- Other Tax Credits-The Senate eliminated tax credits for harbor maintenance, medical device user fees, and certain patent related income

- Increased Fees on Ride-hailing Services- The Senate proposes fee increases for Uber, Lyft, etc.

Should those issues go unresolved, look for them to linger on in the session with the respective branches bringing them up in some form. Also, keep an eye for any vetoes by Governor Baker and when the Legislature decides to take up those override votes

American Rescue Plan.

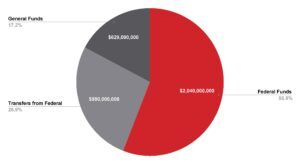

With the passage of ARPA at the federal level, Massachusetts is set to receive roughly $5.3 billion in state fiscal relief, and another nearly $3.4 billion for local governments and other funding.

However, questions remain about the American Rescue Plan in Massachusetts, including:

- Who will allocate the $9B?

- How will they spend it?

- Who will be eligible to receive it?

Look for some tension between the Governor and the Legislature as there are differing opinions as to who gets to spend the money. But ultimately, there will likely be some agreement with a focus on reemployment, job training, shoring up the childcare industry, and strengthening broadband access just to name a few.

Businesses across every sector, including non-profits should be paying attention to ensure they are seeking the funding to help them recover and prosper in the post pandemic economy.

Long-term considerations:

Implementation of Improvements to the Unemployment Insurance Trust Fund

In response to the state of emergency caused by the COVID-19 pandemic, unemployment insurance was expanded across the country to assist employers and employees during the shutdown of non-essential businesses. With the State of Emergency dwindling down, the Commonwealth enacted legislation to start dwindling the deficit created by the high unemployment rates.

In early April, the Commonwealth enacted “An Act Financing a Program for Improvements to the Unemployment Insurance Trust Fund and Providing Relief to Employers and Workers in the Commonwealth” that outlined some key take a ways for employers and employees.

For employers:

- Contributions to the Unemployment Insurance Trust Fund are frozen at the rates set by 2019-2020 levels for the next two years;

- Income from forgiven Paycheck Protection Program loans exempted from taxation; and

- Requires employers to pay a substantially increased rate to the Unemployment Solvency Fund (from 0.58 % in 2020 to 9.23% in 2021)

For the employees:

- Refundable tax credit established for unemployment benefits as long as they are under 200% of the federal poverty level.

Moving forward, the State now is considering allocating some of the American Rescue Plan Act (ARPA) appropriations to help offset the increased costs to employers to help fund the Unemployment Solvency Fund given the drastic rate increase. The Unemployment Solvency Fund usually helps pay for costs incurred to unemployment such as dependent allowances and assistance for businesses that have closed. However, during the COVID-19 pandemic, job loss due to the pandemic was charged to the solvency fund which depleted it. This being said, it was anticipated that the Commonwealth would need 7 years to recover the funds spent. With potential federal funding on the horizon, employers will wait and see if that will offset the rate increase for the Solvency Fund.

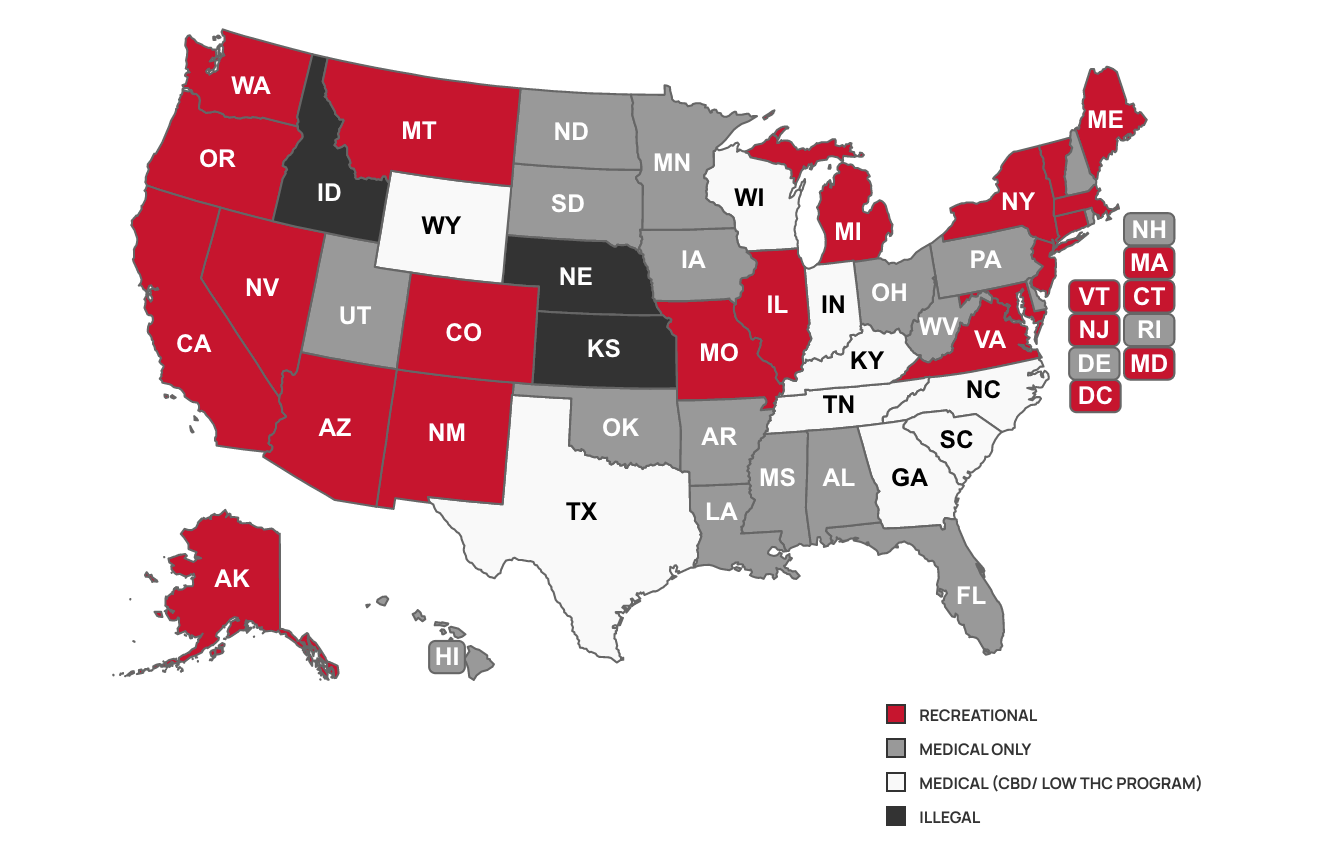

Climate change legislation in Massachusetts

With the Governor’s signature in late March 2021 on An Act Creating a Next-Generation Roadmap for Massachusetts Climate Policy, the state has committed to achieve net-zero carbon emissions by 2050.

Implementation of this roadmap will touch all aspects of life in the Commonwealth. The law requires the executive branch to set interim limits for 2025, 2035 and 2045. Additionally, the legislation requires sublimits for six sectors of the economy, to be set in five-year increments:

- electric power

- transportation

- commercial and industrial heating and cooling

- residential heating and cooling

- industrial processes

- natural gas distribution and service

Further, each five-year emissions limit “shall be accompanied by publication of a comprehensive, clear and specific roadmap plan to realize said limit.”

This legislation comes on the heels of an economic development package from last session that encourages smart development and housing production.

Implementation of the climate change roadmap will have lasting and continuous impacts on the development, construction, property management, and real estate industries across Massachusetts.

Stay tuned for further updates as they unfold. And follow Tenax Strategies on LinkedIn for the latest news as it happens!

The post Massachusetts Legislation Update: June 2021 appeared first on Tenax Strategies.